Managing Aging Parents’ Finances with Ease

Key Takeaways

- As parents age, adult children often step in to help. This article covers how to start conversations, organize key documents, and communicate clearly within the family.

Start the money conversations early

As our parents age, conversations about money can become some of the hardest to have. But discussing your elderly parents’ finances early allows time for thoughtful planning and helps everyone adjust emotionally. It’s important to approach the conversation with sensitivity.

Here are some ways to make sure they feel respected and understood:

- Acknowledge their independence

- Remind them that you’re there to support them, not control the situation.

- Implement changes gradually to make sure they’re comfortable.

Once you’ve started the conversation, you can create a plan that honors your parents’ wishes and keeps them safe.

Organize legal and financial documents

Once everyone is on the same page and has a clear understanding of your parents’ financial picture, effective management becomes possible. To create a “financial snapshot,” gather and secure the following documents:

- Account numbers, bank statements, and bills

- Retirement and investment information

- Credit lines, mortgage, and savings account

- Contact details for financial advisors and other relevant professionals

Establishing a financial power of attorney can also grant you or another trusted family member the legal authority to manage your parents’ finances if your parents are ever unable to do so themselves. Consider discussing this option with an attorney and your parents to find the best solution for their situation.

Also, check that wills, trusts, and beneficiary designations are up to date and reflect your parents’ wishes.

Streamline recordkeeping and bill paying

Bills, payments, and paperwork can overwhelm. Try these strategies to stay organized:

- Monitor recurring subscriptions so nothing is missed.

- Set up direct deposit for retirement or social security payments and use automatic bill pay for recurring expenses. Automating these processes will eliminate delays and the risk of misplaced checks.

- Review insurance plans and debt to ensure you’re prepared to manage them if needed.

- Store logins and passwords securely, and ensure trusted family members can access them.

Communicate clearly and set boundaries

When money and family mix, clear communication and boundaries help things run smoothly. Keeping relatives informed builds trust. Share updates regularly and invite input when needed.

At the same time, it’s important to keep finances separate. Even if combining accounts seems easier, it’s best to avoid that. Shared accounts can create tax or legal complications and even cause tension between family members. Instead, become an authorized user on their account or set up joint oversight.

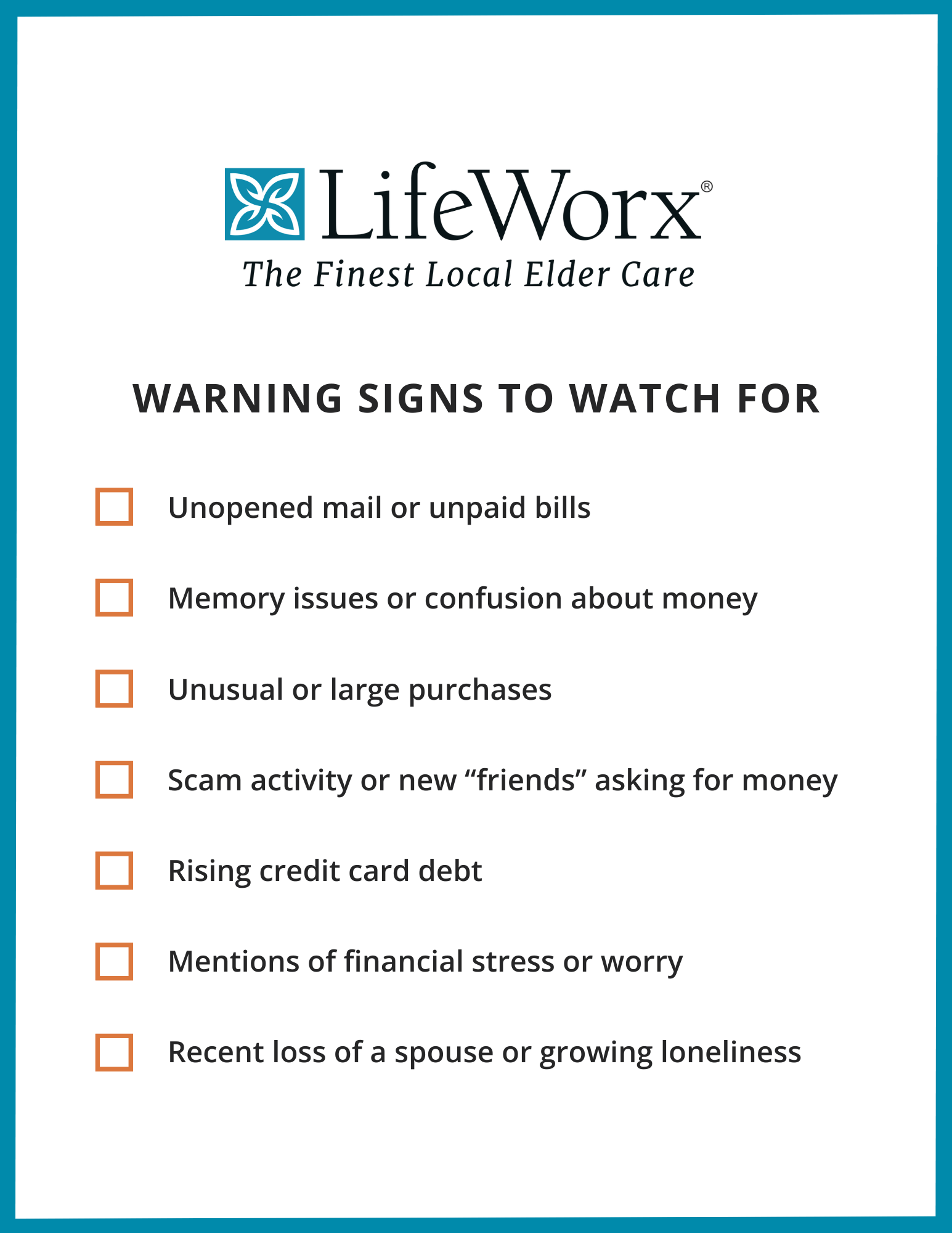

Sometimes managing finances can uncover larger concerns such as missed medications, unpaid bills, or signs of isolation. These may be indicators that your parents need daily support. In-home care services, like those provided by LifeWorx, offer a sense of relief, allowing your parents to age gracefully in the comfort of their home.

Caring for your parents goes beyond managing finances. If your loved one needs additional help with daily activities or companionship, reach out to LifeWorx. Our caregivers deliver personalized, dependable support to help seniors remain safe and independent. Contact us to discuss how we can assist your family.