How to Get Your LTCI Claim Approved

Getting a Long-Term Care (LTC) Insurance claim approved for home care can be a complicated process. Insurance companies tend to have strict requirements, and missing even small details can delay or jeopardize approval. Understanding the requirements, preparing the proper documentation, and scheduling follow-ups with the insurer can impact your success.

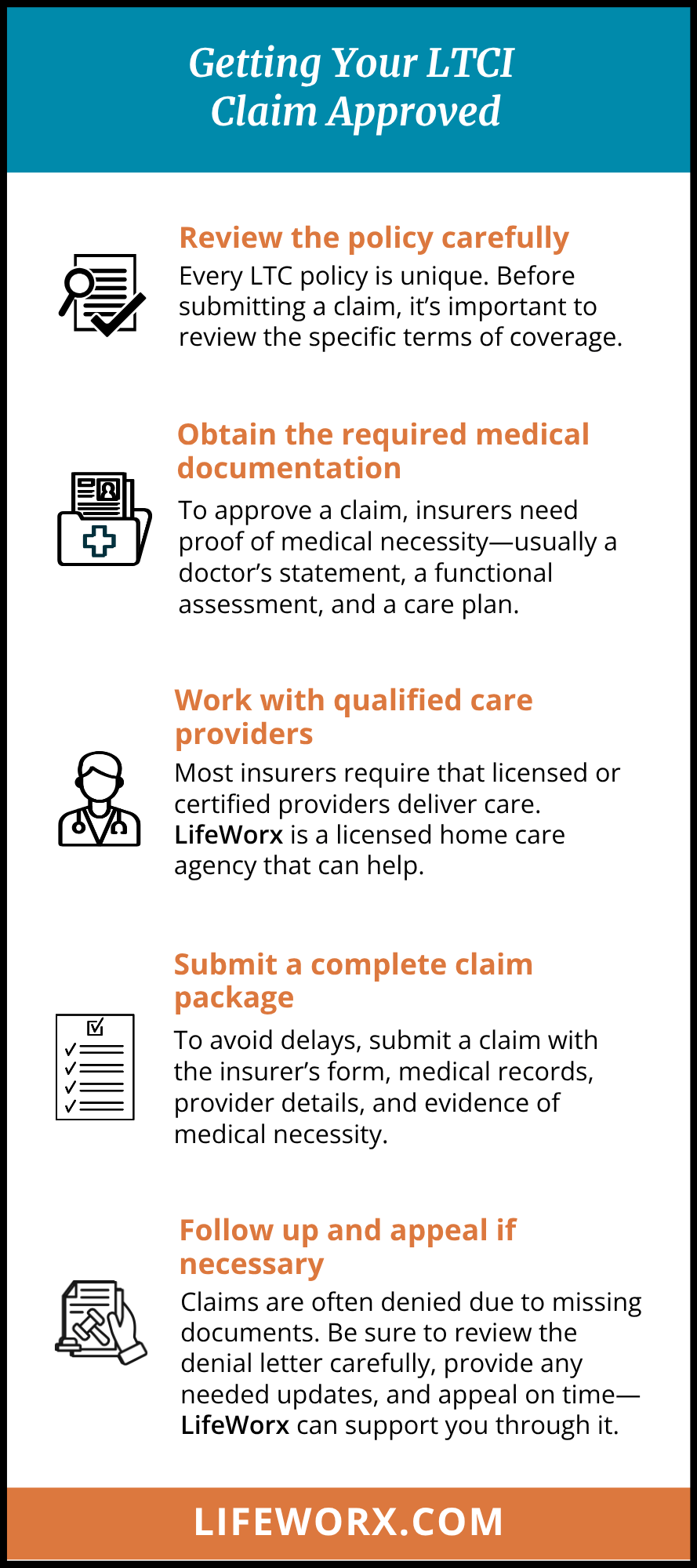

Step 1: Review the policy carefully

Every LTC policy is unique. Before submitting a claim, it’s essential to review the specific terms of coverage:

Eligibility triggers

Most policies require the insured individual to need assistance with at least two Activities of Daily Living (ADLs)—which include bathing, dressing, eating, toileting, transferring, and managing continence— or to have a cognitive impairment, such as dementia or Alzheimer’s, certified by an appropriate physician.

Covered services

Verify whether home care services are explicitly covered and under what conditions. Some policies limit hours or require care to be delivered by licensed professionals, this can be due to the Plan of Care created by your insurance company, or terms that were initially discussed when the policy was purchased.

Elimination periods

Many policies include a waiting period, ranging from 30 to 100 days, before benefits begin, during which you must pay out of pocket. We call this a deductible period.

Step 2: Obtain the required medical documentation

Insurers will not approve a claim without clear evidence of medical necessity. This typically requires:

- A physician’s statement or plan of care confirming the need for home assistance.

- A functional assessment documenting difficulties with ADLs or cognitive decline.

- A detailed care plan that matches the LTC insurer’s requirements.

Make sure the language in the physician’s notes clearly relates to ADLs or cognitive impairment, as insurers rely heavily on these benchmarks. When these letters or assessments are written, it’s critical that the individual conducting them clearly explains the level of help needed and uses industry-specific terms, such as “hands-on” or “total assistance.”

Step 3: Work with qualified care providers

Most LTC insurers require that licensed or certified providers deliver care. This may include home health agencies or licensed nurses.

LifeWorx is a licensed home care agency operating in multiple states across the U.S. and works with most of the long-term care insurance companies, including John Hancock, Genworth, Brighthouse, CNA, Allianz, Prudential, UNUM, MetLife, Washington National, NorthWestern, Lincoln Financial, New York Life, Federal LTC, Bankers Life, Transamerica, State Farm, MassMutual, Mutual of Omaha, and Berkshire.

Step 4: Submit a complete claim package

When submitting your LTC claim, include:

- The claim form from the insurance company (fully completed and signed by the insured or their Power of Attorney).

- Medical documentation (doctor’s notes, cognitive testing, care plan, physician contact information).

- Provider information (licenses, certifications, care agreements).

- Proof of services (invoices and care notes).

The more organized and complete your submission is, the fewer delays you’ll encounter.

Step 5: Follow up and appeal if necessary

Insurance companies frequently deny LTC claims on the first attempt, often citing missing documentation or technicalities. If this happens:

- Request the denial letter in writing and carefully review the reasons carefully.

- Submit any additional evidence or clarification from the physician.

- File an appeal within the insurer’s required timeline. Many appeals are successful once the documentation is corrected. LifeWorx can assist you in filing an appeal if your claim is denied.