Frequent Causes of Long-Term Care Insurance Claim Denials

When it comes to long-term care insurance, many families hope for peace of mind knowing that help is available for aging loved ones. However, the reality of the situation can be quite different. Some policyholders find themselves in a tough situation when claims are denied, even after years of paying premiums. Dealing with a long-term care insurance claim denial can add to the stress for families who are already facing the challenges of declining health.

Here are some common reasons long-term care (LTC) insurance claims are denied that directly affect families, along with practical tips to help manage these issues or successfully appeal a claim.

The insurer says the policyholder isn’t “chronically ill”

To receive approval, insurers need clear evidence that the policyholder is unable to complete at least two Activities of Daily Living (ADLs) or has a significant cognitive impairment. Unfortunately, claims are often denied because of inadequate documentation. That’s why it’s important to gather thorough medical records and detailed assessments right from the start.

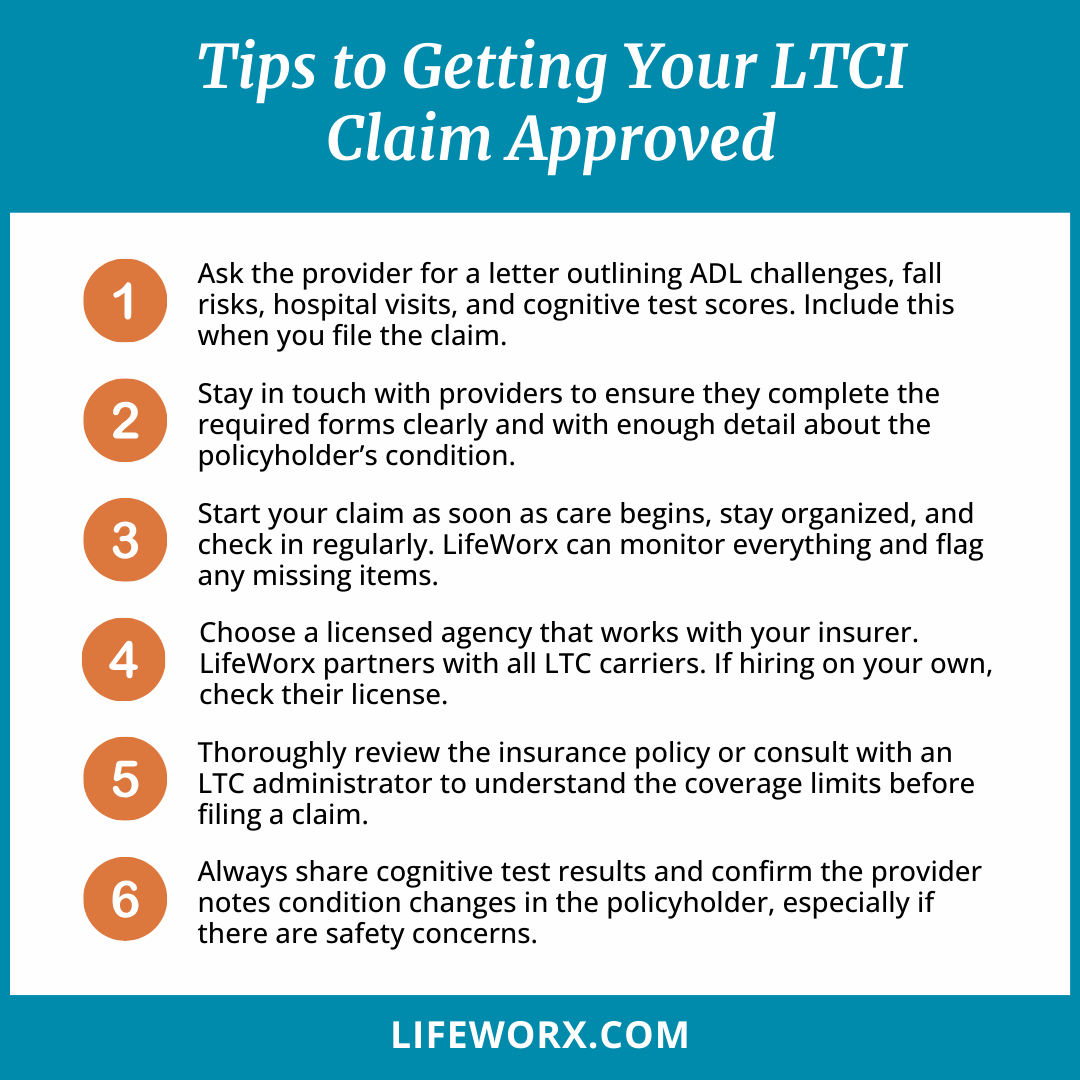

Tip: Ask the provider for a detailed letter that highlights the policyholder’s challenges with ADLs, any fall risks, recent hospital visits, or cognitive test results like MOCA or MMSE. Make sure to include this documentation when you first file the claim.

Missing, insufficient, or poorly completed provider statements

Insurance companies usually require a plan of care, a statement from the physician, or documentation showing a steady decline in health. When those documents are missing or not filled out correctly, it can lead to claim denials.

Tip: Stay in touch with providers to ensure they complete the required forms clearly and with enough detail about the policyholder’s condition.

Delayed claims submissions

Most insurance policies have a time limit of 30 to 60 days after initiating a claim when all required documentation must be submitted. If this deadline isn’t met, the claim can be closed.

Tip: File your claim as soon as care begins and keep track of all necessary documentation. Follow up regularly to make sure everything is submitted on time. If you’re working with LifeWorx, we can help monitor this process and keep you informed if anything is missing.

The caregiver or agency doesn’t meet requirements

Many policies often require specific criteria, such as:

- Working with a licensed home care agency

- Working with a certified Home Health Aide (HHA) or Certified Nursing Assistant (CNA)

- A supervised care plan

- Agency-submitted care notes

Tip: Choose an agency that is licensed to work with your insurance carrier. LifeWorx is licensed to work with all LTC insurance companies (not Medicare). If you hire an independent caregiver, verify that they have the necessary licenses.

Policy exclusions policyholder is unaware of

There are common exclusions that many families might not realize, including:

- Care provided by a family member

- Care outside of the U.S.

- Care that starts before a formal diagnosis

- Residential settings that don’t qualify

Tip: Thoroughly review the policy or consult with an LTC administrator to understand the coverage limits before filing a claim.

Insufficient evidence of cognitive impairment

Claims can also be denied if:

- No results from cognitive tests are submitted

- There’s a lack of documentation regarding wandering or safety risks

- No professional documentation is provided

Tip: Always include testing results and ensure that healthcare providers document the progression and severity of the policyholder’s condition, especially in relation to their safety.

Conflicting assessments

Insurance companies often send a nurse to evaluate the policyholder’s condition. If the policyholder is having a particularly good day or if the nurse is rushed, their assessment may not reflect the daily challenges the policyholder faces.

Tip: Before the assessment, ensure the policyholder isn’t overly tired, and have a family member or caregiver present to represent their daily care needs better.

Understanding the common reasons for claim denials and being proactive in gathering the necessary documents can make a big difference in the claim approval process.